san antonio general sales tax rate

The San Antonio Texas general sales tax rate is 625. 4 rows San Antonio collects the maximum legal local sales tax.

What Are The Most Economically Conservative But Socially Liberal Us States Quora

The 825 sales tax rate in San Antonio consists of 625 texas state sales tax 125 San Antonio tax and 075 Special tax.

. For tax rates in other cities see Florida sales taxes by city and county. San Antonio police seek tips on aggravated robbery at Dollar. Box is strongly encouraged for all incoming mail.

McKinney TX Sales Tax Rate. City of San Antonio Print Mail Center Attn. Plano TX Sales Tax Rate.

Historical Property Tax Rate. The minimum combined 2021 sales tax rate for san antonio texas is. 2021 State.

PersonDepartment PO Box 839966 San Antonio TX 78283-3966. Tax rates are now 64-bit compatible. Odessa TX Sales Tax Rate.

Local Sales Tax Rate a Combined Sales Tax Rate Rank Max Local Sales Tax Rate. For questions regarding your tax statement contact the Bexar County Tax. Current Sales Tax Rates TXT.

There is no applicable city tax or special tax. Northwest - 8407 Bandera Rd. The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax.

San Antonios current sales tax rate is 8250 and is distributed as follows. San Antonio Texas Sales Tax. Texas Comptroller of Public Accounts.

As of January 1 2021. The 825 sales tax rate in. Most Recent as of Jan.

The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose sales and use tax up to 2 percent for a total maximum combined rate of 825 percent. Mesquite TX Sales Tax Rate. PersonDepartment 100 W.

The county sales tax rate is. Southside - 3505 Pleasanton Rd. Bexar Co Es Dis No 12.

Pasadena TX Sales Tax Rate. Historical Tax Rate Files. City Sales and Use Tax.

View the printable version of city rates PDF. Are taxes high in San Antonio. Texas has a 625 sales tax and Bexar County collects an additional NA so the minimum sales tax rate in Bexar County is 625 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in Bexar County.

TX Sales Tax Rate. The san antonio sales tax rate is. San Antonio TX 78205.

The San Antonio Texas general sales tax rate is 625. San Antonio TX 78205. Mailing Address The Citys PO.

0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. San antonio city council approved on Thursday the sale of five properties it owned in. San Antonio TX Sales Tax Rate.

Sales and Use Tax. The 78216 San Antonio Texas general sales tax rate is. San Antonio has a lower sales tax than 100 of Puerto Ricos other cities and counties San Antonio Puerto Rico Sales Tax Exemptions In most states essential purchases like medicine and groceries are exempted from the sales tax or eligible for a lower sales tax rate.

Northside is San. Rate histories for cities who have elected to impose an additional tax for property tax relief Economic and Industrial Development Section 4A4B Sports and Community. Download city rates XLSX.

Midland TX Sales Tax Rate. Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the San Antonio tax rate 0 to 1375 and in some case special rate 05 to 2. Depending on the zipcode the sales tax rate of San Antonio may vary from 63 to 825.

City sales and use tax codes and rates. 0500 San Antonio MTA Metropolitan Transit Authority. Wichita Falls TX Sales Tax Rate.

These files are for use with the Comptrollers software for sales and use tax EDI software. You can print a 7 sales tax table here. State State Sales Tax Rate Rank Avg.

The zone was established in 2000 to. See how we can help improve your knowledge of math physics tax engineering and more. San Antonio Texas sales tax is no different than most other counties in various states throughout the US.

You can print a 825 sales tax table here. 0250 San Antonio ATD Advanced Transportation District. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax.

The total sales tax rate in any given location can be broken down into state county city and special district rates. City of San Antonio Attn. Physical Address 100 W.

Northeast - 3370 Nacogdoches Rd. There is no applicable county tax. 4 rows San Antonio.

TOTAL RETAIL TRADE. Fast Easy Tax Solutions. 1000 City of San Antonio.

Hours Monday - Friday 745 am - 430 pm. 0125 dedicated to the City of San Antonio Ready to Work Program. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City.

What is Texass tax rate. Waco TX Sales Tax Rate. For tax rates in other cities see Texas sales taxes by city and county.

Object moved to here. Ad Find Out Sales Tax Rates For Free. San Antonio collects the maximum legal local sales tax.

The current total local sales tax rate in San Antonio. The total sales tax rate in any given location can be broken down into state county city and special district rates.

My Specialization Is In Irs And Illinois Department Of Revenue Tax Problems I Represent Many Individuals And Businesses With Sale Tax Lawyer Business Tax Irs

Understanding California S Sales Tax

Sales Tax Rates In Major Cities Tax Data Tax Foundation

How To Calculate Taxes And Discounts Basic Concept Formulas And Examples Cuemath

Texas Sales Tax Guide And Calculator 2022 Taxjar

Texas Sales Tax Guide For Businesses

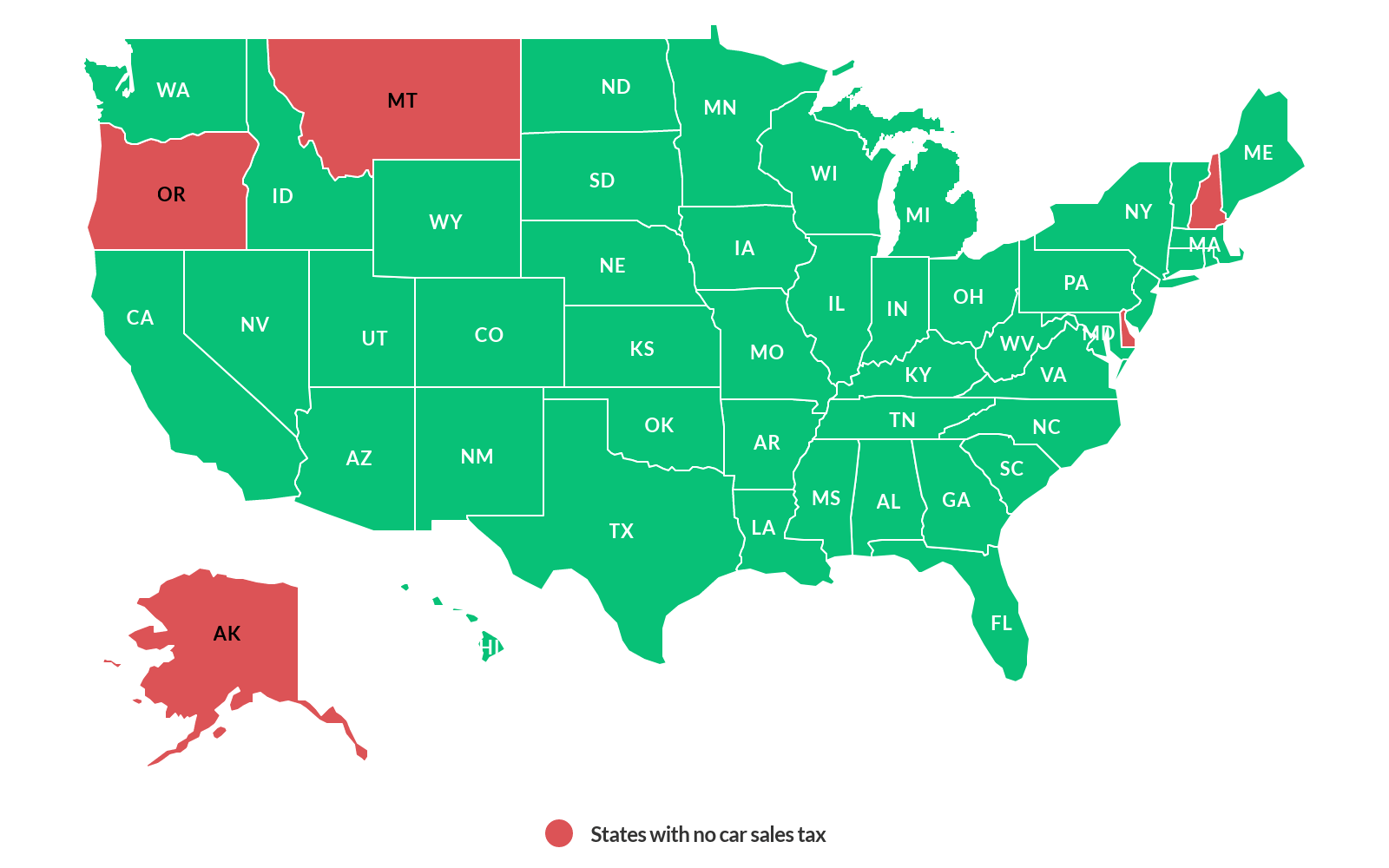

Is Buying A Car Tax Deductible Lendingtree

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

Understanding California S Sales Tax

Texas Sales Tax Guide For Businesses

Sales Tax Rates In Major Cities Tax Data Tax Foundation

How To Get Tax Refund In Usa As Tourist For Shopping 2021

Understanding California S Sales Tax

Understanding California S Sales Tax

Understanding California S Sales Tax

Financial Statement Notes Example Everything You Need To Know About Financial Statement Note Financial Statement Personal Financial Statement Financial

How To Register For A Sales Tax Permit Taxjar